Indian Aerospace Industry – Where Are the Tier-1s?

Indian Aerospace Industry – Where Are the Tier-1s?

What India Needs to Leverage in the Fastest Growing Aviation Market

The aerospace and defense industry is ripe for Indian MSMEs and startups to leverage. The domestic players will have huge opportunities in technological as well as business partnerships in the country’s ecosystem as well as with global entities.

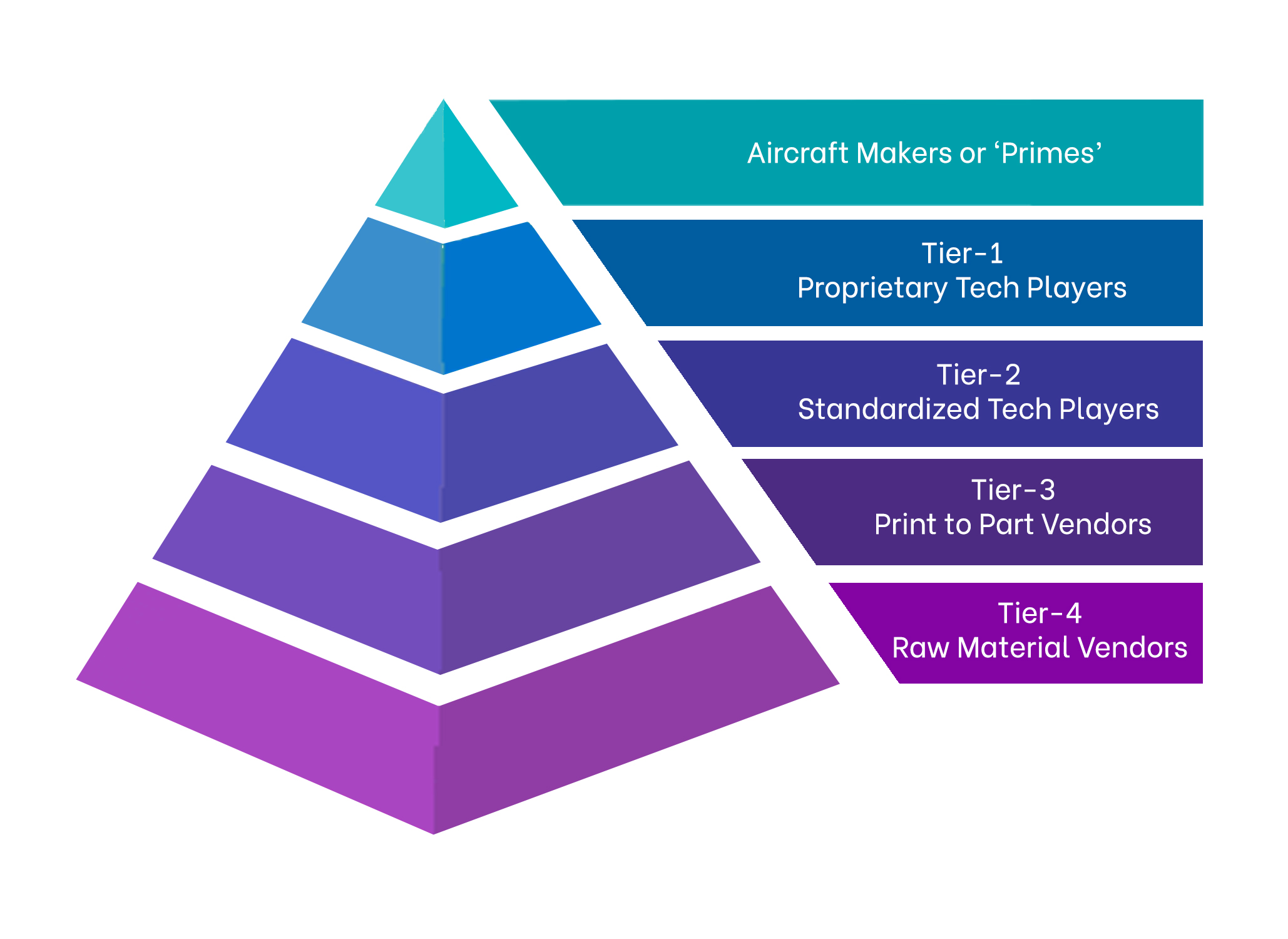

Behind TimeTooth’s successful development of dozens of ground-breaking products such as the Landing Gears and Aircraft Seats, is how we look at the status and future of the Indian aerospace industry. The global aerospace industry is a fragmented one, with multiple players in the supply chain. The best way to understand it is to view it as a value pyramid.

Aerospace Industry: Value Pyramid

Aircraft Makers: The Primes

At the top of the value pyramid are the aircraft manufacturers (often termed as “Primes”) – some of the largest being Airbus, Lockheed Martin, and Boeing. In India, HAL (Hindustan Aeronautics Ltd.) is a Prime, making 3 types of helicopters and 4 types of fixed-wing aircrafts. These “Primes” or OEMs control design, manufacturing, and assembly functions – the most critical components of the value chain. They don’t find it optimal to build the entire aircraft in-house, but get various components, systems, and parts manufactured and supplied by vendors.

Traditionally, the Primes were themselves involved in fuselage (body), wings and empennage (tail). In the current times, Primes take care of the assembly of the aircraft, with components and sub-assemblies coming from Tier-3 suppliers. As an example, TASL makes empennage for C130 transporter and the Cabin for Sikorsky S-92.

The fuselage, wings, and empennage amount to ~40% of the total manufacturing costs. These are the most critical components, and hence offer the biggest barrier to entry for new players. The rest of the ~60% of the aircraft value is outsourced, which is a major driver for proliferation and growth of the aerospace component industry. An aircraft can take 8-15 months to build, so the Primes lock most of their cost through long-term contracts with the suppliers.

Tier – 1

Tier-1 suppliers develop and provide niche proprietary technologies and systems. They create their own IP, invest heavily in the same, and also enjoy the highest profitability among the vendors. They have to also get these products to match the stringent regulatory requirements.

Image: Landing Gear Designed by Timetooth

Image: Landing Gear Designed by Timetooth

** Examples are engine-makers like GE, Pratt & Whitney, and Rolls Royce. Landing gears, and aircraft seats also fall in this category – and that’s where TimeTooth has been making remarkable contributions. With the aircraft seat of TimeTooth’s own design – a first by an Indian company – we are on the path to become India’s first Tier-1 seat designer-supplier.

Image: Energy-Absorbing Seats for Helicopters

Image: Energy-Absorbing Seats for Helicopters

Tier – 2

Tier-2 vendors also have proprietary tech, and support the OEMs with mechanical parts, flight control actuators, wheels, brakes, avionics, hydraulics, etc. Several of these are also fairly standardized parts and components like mechanical switches, wires, door handles. They have their own regulatory requirements to follow as well. This tier enjoys moderate profitability coupled with moderate IP investment and better revenue predictability as compared to the Tier-1.

**Examples here include Moog Inc, Honeywell, Eaton, etc.

Tier – 3

Tier-3 vendors bring in the scale and supply reliability required by the OEMs. When the aircraft manufacturers give out work to the Tier-3 vendors, the design of the part has been already developed, the process established, and the expected performance benchmarked. The vendor follows these and produces the part – this is termed as a ‘Print-to-Part’ contract. The components manufactured by these vendors are aero-structures, interiors, in-flight entertainment systems, bearings, plastic parts and casings, etc.

**Indian examples are many: Aequs Aerostructure Assemblies), Bharat Forge, Sansera Aerospace (CNC machining), Tata Advanced Systems Ltd (Aerostructure Assemblies).

Tier – 4

Tier-4 suppliers are the ones providing raw materials like aerospace grade copper, aluminum, steel, titanium, etc., as well as fabrics, carbon fibers, precursors for composite materials. These suppliers are commodity vendors forming a fundamental part of the supply chain. While crucial to the industry, they suffer from volatility in the larger commodity markets.

**Some key examples are JACO Aerospace, Nippon Steel, JPS Composites, Arville (UK), Celanese, Solvay.

Tier-1 in India

There are very few Indian Tier-1 suppliers: HBL Power Systems Ltd. (Hyderabad) is the pioneering Indian Tier-1, supplying aircraft batteries since 2013. Accord Software and Systems is a Tier-1 for aircraft navigation systems, competing worldwide with the likes of Garmin. There are a few more in small niches. The number and size of Indian Tier-1 is dwarfed by those in Germany, Italy, Switzerland, Japan, Taiwan etc. – countries without their own Primes, and with a smaller domestic aviation market.

For several newcomers, Breaking ground as an Indian Tier-1 supplier has proved tough. This is because traditionally the Indian Prime – HAL – has played the role of its own Tier-1. Moreover, the default for Tier-2 has been the more established foreign players; while Indian companies have been looked at as limited to Tier-3.

Developing our own line-up of Tier-1 suppliers is crucial for the long-term success of the Indian aerospace industry. India will need to nurture its innovative Tier-1 companies on various levels – making investments easier, drafting helpful policies, developing the infrastructure, and lowering barriers for new entrants to work with the government and defense forces.

On these lines, one of the major Defence R&D reforms since 2014 was the removal of the “prior experience” and “minimum turnover” rejection clauses in Defence Procurement. Unfortunately in the new Defence Procurement Processes like DcPP (Development cum Production Partner, a paradigm that started in 2020) size based exclusion criteria are back. We need to lower the barriers and provide growth opportunities to innovative Indian companies to make the most of the rapid growth in this sector.

Drivers for Growth of the Aerospace Industry

For the global aerospace industry in general and the Indian industry in particular, there are several key drivers for the growth. Specifically, the majority of this growth is being driven by emerging markets – shifting from US & Europe to Asia Pacific. India, among them, is now the third largest aviation market, and the fastest growing one.

For the commercial aerospace sector:

- The global air traffic has grown at a steady CAGR of 5% since the late 1990s, and has been resilient to recessions, financial crises, wars, oil shock, and the 9/11 attack. [1]

- Air traffic growth rate has been at 1.5-2.5x the global GDP growth rate, thus claiming an ever increasing component of the overall GDP. [1]

- Global load factor (capacity utilization) for airlines is already around 80%, and further increase in traffic will be met by fleet expansion. [1]

- India is now the fastest growing aviation market. [2] Indian policymakers have spotted this opportunity: the National Civil Aviation Policy (NCAP 2016) emphasizes civil aerospace manufacturing in the country. [3]

- Currently, global aerospace OEMs source more than 70% of their systems from suppliers in the US and the EU. There is a push to de-risk and diversify the supply chain by developing suppliers in Asian regions, especially India and China – which are also close to the regions with the most consumption. [3]

For the defense aerospace sector:

- India’s Ministry of Defense (MoD) invested INR 4856.81 Bn for defense spending in FY 2021, up from INR 3551.50 Bn in FY 2017, an expansion at a compound annual growth rate (CAGR) of 8.14%.

- In May 2017, the Strategic Partnership Policy was included in Defence Procurement Procedure. Under this, Indian companies will partner with global OEMs to manufacture helicopters and fighter jets among other defense systems. In the 2018-19 budget, two defense industrial corridors have been announced – one in Uttar Pradesh, and one in Tamil Nadu. [4] Such developments are providing the necessary impetus for Indian companies to make significant headways in the defense aerospace sector.

Finding our Edge: Developing Indian Tier-1 Suppliers

To leverage India’s position as the most rapidly growing aviation market in the world, we need to find our edge and focus on our strengths.

There are several compelling reasons for Indian companies to achieve the biggest impact and gain a significant market share by returning to the most profitable value layer: the Tier-1.

1. Availability of Highly Effective Design Talent

Tier-1 suppliers typically need to develop their own IP, and require significant upfront investment. Major components of this investment are the designers time, manufacturing process design, quality aspects, etc. Indian companies specifically have an advantage both due to the high effectiveness of the design engineers, as well as the cost. Due to this, several foreign players now have design engineering teams based in India. This has helped create a significant Indian talent pool trained in various aerospace components and systems design aspects.

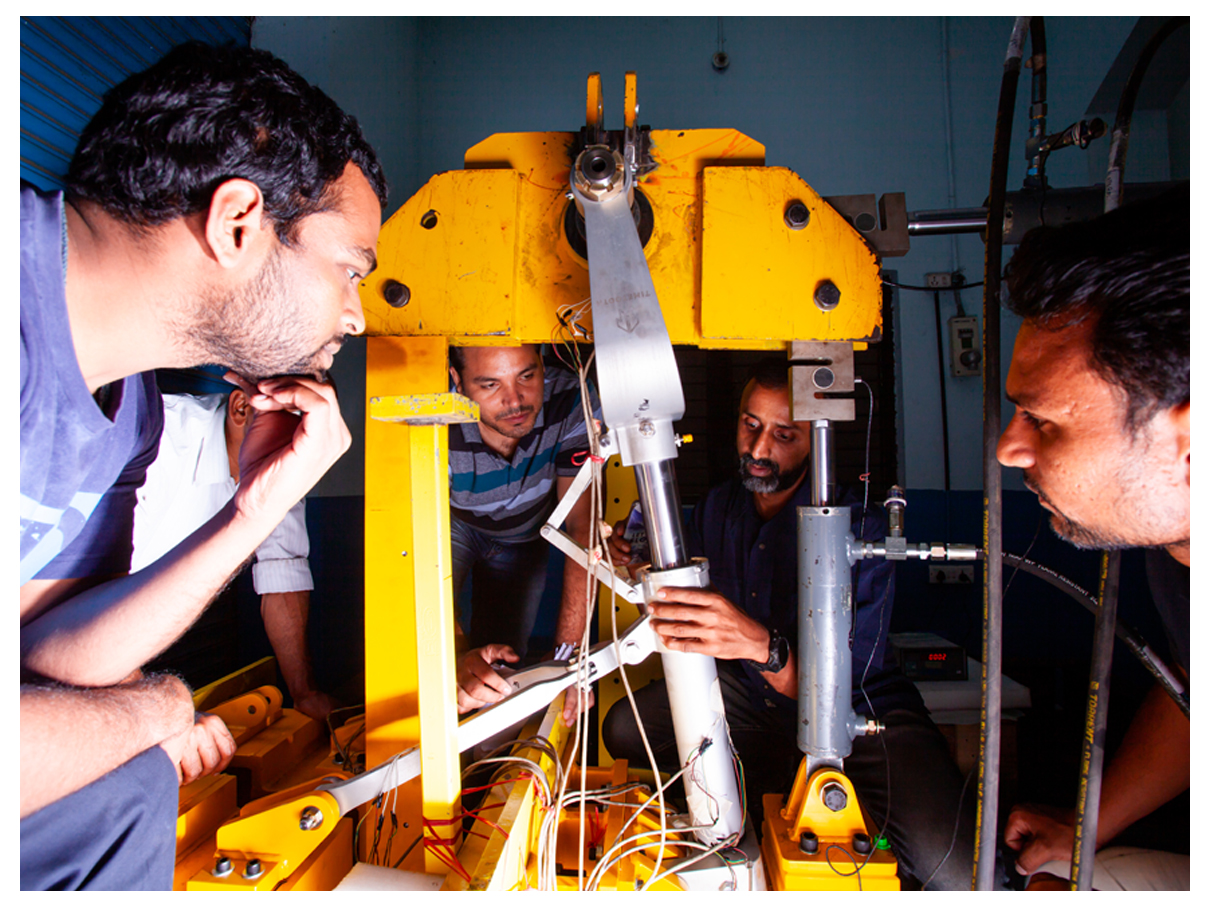

Image: Timetooth Engineers Working on the Landing Gears

Image: Timetooth Engineers Working on the Landing Gears

2. Opportunity for Direct Sale to End Customers

Another aspect of Tier-1 supply is that several of the system components fall under ‘customer specified equipment’. Thus, such equipment can be directly bought by the customer from the Tier-1 supplier.

3. Compatibility with Global Regulations

Moreover, the regulations in the aerospace sector are fairly uniform globally, and there is not much difference between Indian and foreign regulations. This opens up wider global markets for good Indian suppliers.

Image: As of 2022, Timetooth is AS 9100D Certified for Engineering Design & Manufacturing of Aerospace & Defence Products

Image: As of 2022, Timetooth is AS 9100D Certified for Engineering Design & Manufacturing of Aerospace & Defence Products

4. Barriers for Tier-2 & 3 for Indian companies

In Tier-2 and Tier-3 supply areas, the key drivers of cost are material costs and skilled labour. In India, the material costs are typically the same or at times higher than global costs. There is low-cost labour available, but efforts and investments in training are needed to get the workforce to operate at high productivity at par with the global counterparts.

Considering these, Tier-1 is the value layer where innovative Indian companies can best leverage their strengths and create valuable technology businesses. It is imperative that Indian Primes and policy makers alike create a nurturing environment and help Indian Tier-1s flourish.

Timetooth at Aero India 2023

The recent Aero India show held in Bangalore in February 2023 saw an explosion of innovation coming out of India. The largest Aero show in Asia saw several first-in-India products on display, showcasing the deepening technological expertise gained by Indian companies.

TimeTooth unveiled the first Indigenous Aircraft seat – designed & developed by our expert team of engineers. We also displayed the rest of our portfolio with Aircraft Landing Gears, Mine Blast resistant seats, Helicopter Energy Absorbing Seats, and Medical and Military Exoskeletons.

Image: The first indigenous Aircraft seat developed by TimeTooth unveiled by Dr. Abhay Pashilkar, Director NAL

Image: The first indigenous Aircraft seat developed by TimeTooth unveiled by Dr. Abhay Pashilkar, Director NAL

Awesome Amitav. Great going. Very happy for you and your team!